Join us in building the future, one successful venture at a time.

About

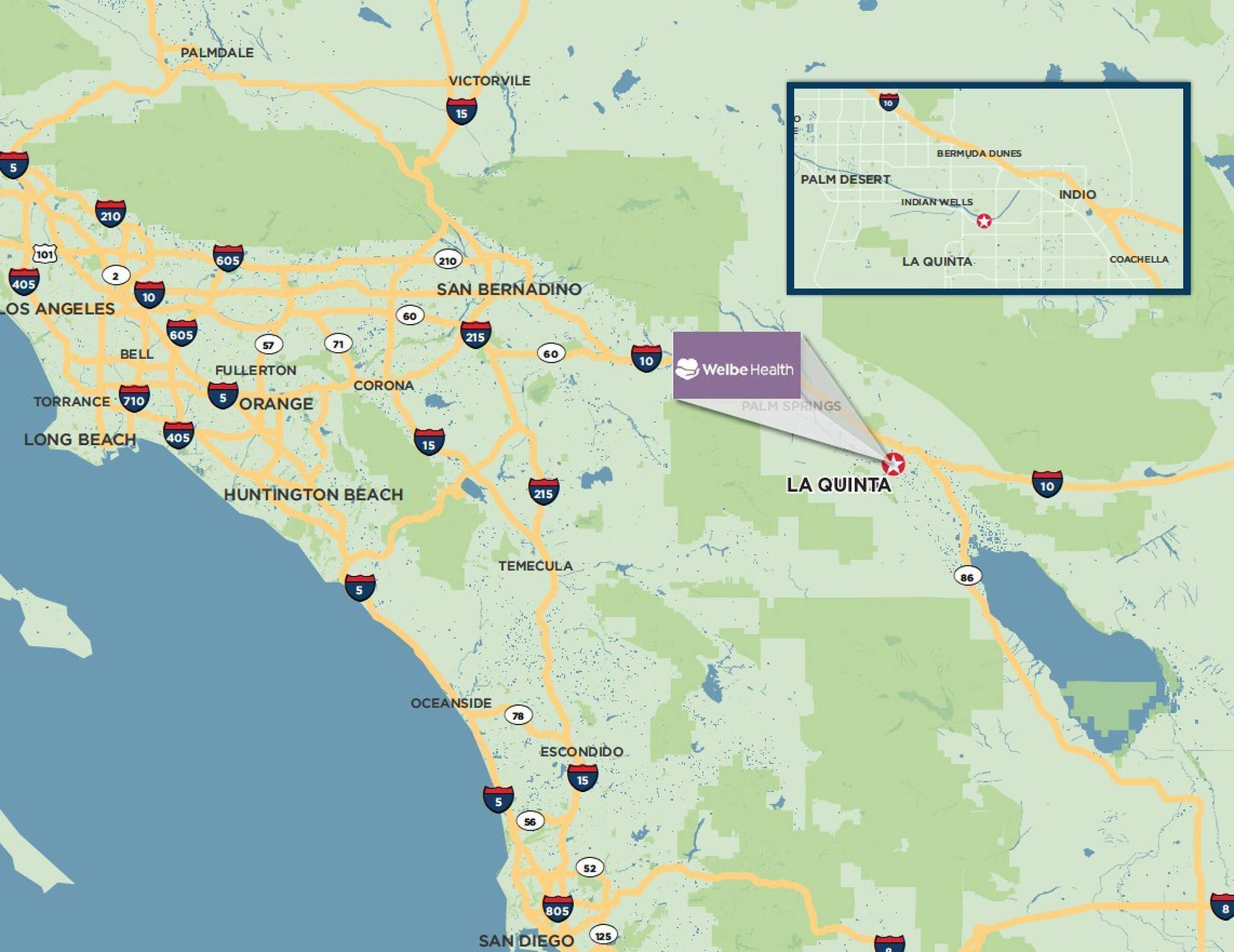

Apeiron is a buyout firm with a unique dual focus. we acquire high-growth enterprise software firms and optimize real estate portfolios. But we're not just about profit; we're committed to significant social impact. We're actively working to provide campuses to the Masonic Homes of California. We believe in driving strong financial returns while making a tangible difference in our communities.

Investment Focus

Large-Brand Hospitality

Acquiring properties under nationally recognized brands such as Hilton, Marriott, and IHG. This strategy leverages the brand loyalty, operational expertise, and professional management systems of established hospitality giants to mitigate risk and drive strong performance in a growing market.

Contact us

Industrial & Self-Storage

Investing in industrial and self-storage facilities, two sectors known for their consistent performance and high demand. The focus will be on acquiring well-located, professionally managed assets that benefit from e-commerce growth and the increasing need for personal and business storage solutions.

Contact us

Multifamily (1990s or Newer)

Focusing on multifamily properties built in 1990 or later. We will target value-add opportunities with a cap rate of 8% or higher, which may involve acquiring under-managed properties and implementing strategic renovations to increase rental income and asset value.

Contact us

Grocery-Anchored Retail

Acquiring retail properties with a grocery store as the anchor tenant. These assets are considered highly resilient due to consistent foot traffic and essential nature of their tenants, providing a stable income stream and strong tenant durability.

Contact us

Addressing the Wealth Gap

Prince Hall Endowment Fund

Imagine a world where every Prince Hall Grand Lodge functions as an individual hub for innovation, mentorship, and capital.

Our fund is making this vision a reality. We're strategically endowing these Grand Lodges with venture capital funds, empowering them to identify, nurture, and invest in the next generation of Black founders in enterprise software. This directly tackles the severe funding disparity that has historically held back Black entrepreneurs.

We're not just investing in high-growth tech; we're investing in an ecosystem of economic empowerment, purpose-driven innovation, and generational wealth creation, all rooted in the very fabric of our brotherhood.

Are you ready to join us in manifesting this transformative future?

Our fund is making this vision a reality. We're strategically endowing these Grand Lodges with venture capital funds, empowering them to identify, nurture, and invest in the next generation of Black founders in enterprise software. This directly tackles the severe funding disparity that has historically held back Black entrepreneurs.

We're not just investing in high-growth tech; we're investing in an ecosystem of economic empowerment, purpose-driven innovation, and generational wealth creation, all rooted in the very fabric of our brotherhood.

Are you ready to join us in manifesting this transformative future?

Follow

Contact us

We're here to help! Send any questions you have over to us. We look forward to hearing from you.